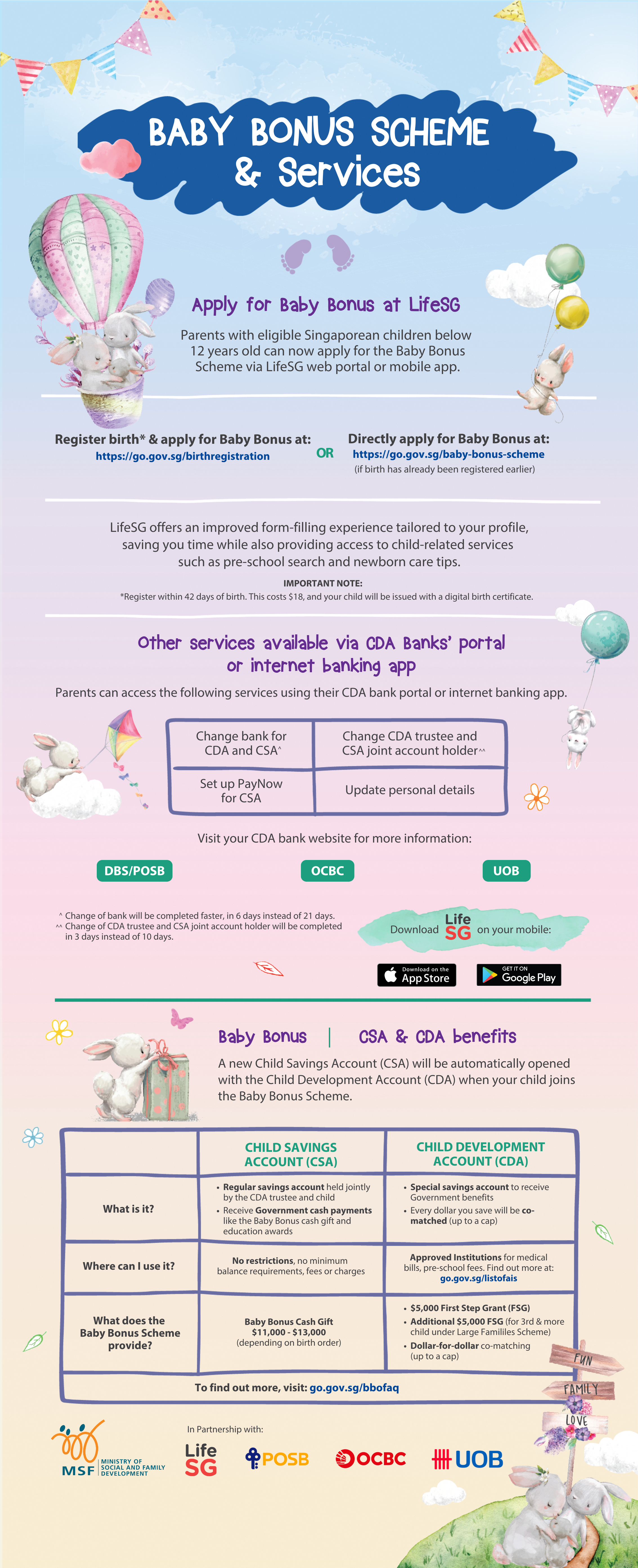

- Apply for the Baby Bonus Scheme when you register for your child’s birth at the LifeSG app

Children bring much joy and love to the family. To support couples in their decision to have more children, the Baby Bonus Scheme helps to manage the costs of raising children. The Scheme is part of the Marriage and Parenthood Package and includes a Cash Gift and Child Development Account (CDA) benefits.

The current scheme for Singapore Citizen children whose date of birth is on or after 18 Feb 2025, is as follows:

| Baby Bonus Scheme Benefits | |||

|---|---|---|---|

| Birth Order | Baby Bonus Cash Gift | CDA | |

| First Step Grant (No initial deposit from parents required) | Maximum Government Co-Matching | ||

| 1st Child | $11,000 | $5,000 | $4,000 |

| 2nd Child | $11,000 | $5,000 | $7,000 |

| 3rd Child | $13,000 | $10,000* | $9,000 |

| 4th Child | $13,000 | $10,000* | $9,000 |

| 5th and Subsequent Child | $13,000 | $10,000* | $15,000 |

Joining the Scheme

From 1 July 2024, all parents can apply for the Baby Bonus Scheme at LifeSG or via LifeSG mobile app.

Baby Bonus Cash Gift

The Baby Bonus Cash Gift has been enhanced for eligible children born from 14 Feb 2023. Parents will receive the Cash Gift every 6 months till the child turns six-and-a-half years. A child is eligible for the Cash Gift if:

- He or she is a Singapore Citizen; and

- His or her parents are lawfully married.

| Time | Amount of Cash Gift to be Disbursed | |

|---|---|---|

| 1st and 2nd Birth Orders | 3rd and Subsequent Birth Orders | |

| At birth | $3,000 | $4,000 |

| 6 months | $1,500 | $2,000 |

| 12 months | $1,500 | $2,000 |

| 18 months | $1,000 | $1,000 |

| From 2 years until 6.5 years | $400 every 6 months | $400 every 6 months |

| Total | $11,000 | $13,000 |

Child Development Account (CDA)

The CDA is a special co-savings account for eligible Singapore Citizen children. When a CDA is opened at DBS/POSB, OCBC or UOB, the child will receive the (a) CDA First Step Grant which will be automatically deposited into the CDA without parents having to save first; and (b) dollar-for-dollar Government co-matching for each dollar that parents deposit in the CDA, up to the maximum Government co-matching amount. Parents can save into and use the CDA until 31 December of the year the child turns 12 years old.

CDA funds can be used at the Baby Bonus Approved Institutions (AIs) for the following expenses:

- Fees for registered childcare centres, kindergartens, special education schools and early intervention programmes

- Medical expenses at healthcare institutions such as hospitals and General Practitioner clinics

- Premiums for MediShield Life or MediSave-approved private integrated plans

(Note: If premium is paid by MediSave, there must be cash top-up to MediSave before the CDA can be used to reimburse the parent) - Assistive technology devices

- Eye-related products and services at optical shops

- Approved healthcare items at pharmacies

- Childminding fees under ECDA's Childminding Pilot

For more information on the approved uses of the CDA, please visit this link. You can also search for an AI here.

Any savings left in the CDA after the year the child turns 12 will be transferred to his or her Post-Secondary Education Account (PSEA)*. Parents who have not saved up to the co-matching cap can continue to contribute to the PSEA for their children’s post-secondary education needs in Singapore and receive the co-matching amount until the cap is reached, or when the child turns 18, whichever is earlier.

* Subject to a cap, comprising the sum of the applicable CDA Government co-matching cap (based on the child’s birth order), the equivalent deposits made by parents, any ad-hoc top-ups to the CDA made by the Government, and accrued interests.

Child Development Account (CDA) related services are directly available from your CDA bank portal/mobile app:

- Change bank for CDA and CSA

- Change CDA trustee and CSA joint account holder

- Set up PayNow for CSA

- Update personal details of CDA trustee and CSA joint account holder

Child Savings Account (CSA)

From 1 July 2024, when a child is enrolled into the Baby Bonus Scheme, a Child Savings Account (CSA) will be opened automatically at the same time when a CDA is opened for a child. The CSA is a joint-savings account (jointly held by the CDA trustee and the child) that allows the child to conveniently receive the Government cash payments such as:

- Baby Bonus Cash Gift

- Education awards

- Financial assistance

Overview of Baby Bonus Scheme and Services

Click the image below to download the eDM